Offshore Tax Claim

- Easy eligibility check

- Apply online in minutes

- Stress-free tax refund process

Are you in the offshore industry as an oil rigger and think you may be due a tax rebate? Well, find out whether you’re entitled to make a Tax claim by answering a few simple Tax-related questions below.

Submit Your Claim

Do you work in lots of different locations to do your job and think you may be due a tax rebate? Well, find out whether you’re entitled to make a Tax claim by answering a few simple Tax-related questions below.

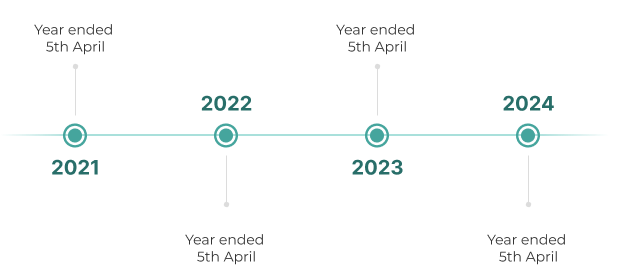

How Far Back Can I Claim?

Current legislation in the UK says you can go back up to four Tax years when claiming a Tax rebate. This means at the current moment in time you can make a claim for the following periods:

- Year ended 5th April 2021

- Year ended 5th April 2022

- Year ended 5th April 2023

- Year ended 5th April 2024

Effectively this means you can claim Tax relief from 6th April 2020.

Over such a long period of time wage slips and p60s can be lost or misplaced. This isn’t a problem as you have lots of ways to obtain this information.

How Do I Make a offshore Tax Claim?

Easy! Let Swift Refunds do the hard work you!

Claiming Tax back directly from HMRC can involve some serious number crunching and you really must know what you’re doing. For example, would you feel confident that you’re making the maximum claim. Would you feel comfortable knowing that an incorrect Tax claim can mean that you could get fined and penalised?

Let Swift Refunds take the hassle out of your Tax rebate claim and contact us today.

Customer Stories

Civil engineer Dean claimed back over £520

Hi, my name is Dean and I work as a civil engineer. Richard contacted me via Linkedin regarding a tax return that I might be owed he took me through step by step and was always at the end of the phone to get me my return. Now I’m £520 better off thanks to Rich, great work Swift Refunds!

Dean, Civil Engineer

Plant Operator Scott claimed back over £2,000

Hi there, my names Scott I’ve been using Swift for the last 2 years, I’ve just got over £2,000, all you need to do is fill out the easy forms and Swift do the rest it’s really that simple.

Scott, Plant Operator

Travel expenses for oil rig workers

If you’re working offshore on an oil rig, you’re probably on the hook for more than just travel and accommodation costs. There’s a wide range of tax deductions for oilfield workers on offer, depending on your circumstances, you might also be owed tax relief on things like:

- Laundry and maintenance of your specialised work clothing.

- Upkeep and replacement of any essential tools you need for your job.

- Subscription fees to professional bodies.

- Hotel costs – you may find yourself stuck in a hotel the night before you head out to the rig.

- Expenses whilst waiting to fly out.

If you don’t fancy the idea of keeping track of all the available tax deductions for offshore workers, you could still make an offshore tax rebate claim. The Flat Rate Expenses scheme can help simplify things by listing specific amounts of tax relief you can claim for common costs. You may not get back everything you’re owed, but it can take some of the bookkeeping out of the process.

How Long Does A Tax Claim Take?

How long Tax takes to come back depends on two things:

How fast you can get the required information to ourselves

How busy HMRC are, which depends a lot on what time of the year it is

The sooner you start a claim process, the better as it can tax 8-12 weeks for HMRC to process a tax refund.

As deadlines apply for making claims, we advise you get in touch as early as possible to avoid disappointment.