TAX REFUNDS UK - CLAIM A TAX REFUND

- Easy eligibility check

- Apply online in minutes

- Stress-free tax refund process

Many UK residents under the PAYE (pay as you earn) system are eligible for a tax refund and aren’t aware. We understand that it can be a stressful process to claim a tax refund from the HMRC, but with Swift Refunds, you won’t need to lift a finger!

Tax Refunds UK - Claim Now!

Do you think you may be due a tax refund? Well, find out whether you’re entitled to make a tax claim by answering a few simple questions below with our online form.

What Is a Tax Refund?

A tax refund is a reimbursement made to the taxpayer on any excess amount paid in taxes to the HMRC for that financial year. If you have been paying more tax than necessary on each paycheck, you could be owed a large tax refund. Many UK taxpayers on the PAYE system are owed a tax refund without them being aware, which is where we come in to make things easier!

What Can I Claim a Tax Refund On?

If you have used personal funds to cover work costs and expenses and your employer does not cover them, you can claim a refund on:

- Food and drink on the go

- Vehicles for work use

- Fuel/mileage costs

- Travel expenses

- Overnight expenses (food in certain circumstances)

- Rail tickets (single & season tickets)

- Uniforms and work clothing

- Tools and work equipment needed to carry out your job

- Cleaning costs for uniforms

- Professional fees, subscriptions & union fees

How Far Back Can I Claim?

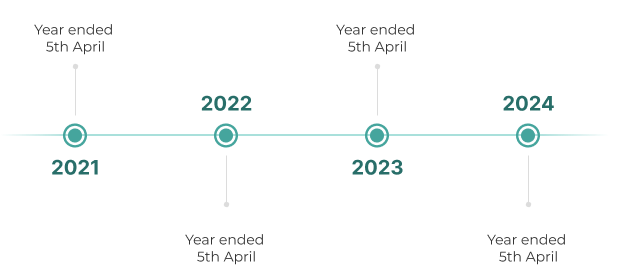

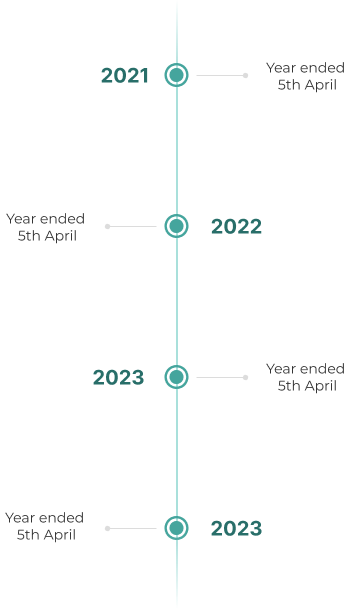

Current legislation in the UK says you can go back up to four tax years when you claim a tax refund. This means at the current moment in time you can claim for the following periods:

- Year ended 5th April 2021

- Year ended 5th April 2022

- Year ended 5th April 2023

- Year ended 5th April 2024

Effectively this means you can claim Tax relief from 6th April 2020.

How Do I Claim Tax Refunds UK?

Easy! Let Swift Refunds do the hard work for you!

Claiming Tax back directly from HMRC can involve serious number crunching and you really must know what you’re doing. For example, would you feel confident that you’re making the maximum claim? Would you feel comfortable knowing that an incorrect tax claim can mean that you could get fined and penalised?

Minimise the stress and let the experts handle your tax refunds. Contact us today if you have any questions.

Customer Stories

Civil engineer Dean claimed back over £520

Hi, my name is Dean and I work as a civil engineer. Richard contacted me via Linkedin regarding a tax return that I might be owed he took me through step by step and was always at the end of the phone to get me my return. Now I’m £520 better off thanks to Rich, great work Swift Refunds!

Dean, Civil Engineer

Plant Operator Scott claimed back over £2,000

Hi there, my names Scott I’ve been using Swift for the last 2 years, I’ve just got over £2,000, all you need to do is fill out the easy forms and Swift do the rest it’s really that simple.

Scott, Plant Operator

How Long Do Tax Refunds UK Take?

The duration of your tax refund process can depend on these two factors:

- How fast you can get the required information to Swift Refunds.

- How busy HMRC are, which depends a lot on what time of the year it is.

The sooner you start a claim process, the better, as it can take 8-12 weeks for HMRC to process a tax refund.

As deadlines apply for making claims, we advise you to get in touch as early as possible to avoid disappointment.

Common Tax Refunds UK Questions

You can backdate your expense claims for the last four years. To start a tax refund claim you will need the following information:

- Photo ID (driving license and passport)

- Or, if you only have one of these you can provide proof of address (bank statement, utility bill, or tax bill)

- P60 or payslip for each tax year you wish to claim for

Most workers, whether employed or self-employed may be due a tax refund for work-related items, expenses or because they have paid too much tax in the financial year. HMRC do not know everyone’s individual circumstances, and it is up to the taxpayer to contact HMRC to see if they are entitled to any tax relief.

Other reasons for a tax refund may include pension payments, redundancy payments, interest from a savings account, PPI, or UK income if you are living abroad.

All claims for tax refunds and rebates are reviewed on a case-by-case basis. Use our tax claim form and answer a few simple questions to see if you could be entitled to make a claim.

The time it takes to receive your tax refund can vary based on several factors, including how you submit your claim and the complexity of your situation. With standard claims, it takes 8-12 weeks to process. For fast-track claims, it takes 6-8 weeks.

Claiming a tax refund directly through the HMRC doesn’t always incur a fee, however, many individuals and businesses choose to use professional services, like the service we offer at Swift Refunds, to ensure their claims are accurate and maximised, which does have a fee. We understand that making a claim can be extremely time-consuming, and any small mistake can incur a fee, which is why we offer a 100% Swift Guarantee, meaning that you don’t have to worry about HMRC asking for any of your money back. As long as you give us full and accurate information, if HMRC doesn’t agree with how much we’ve claimed and asked for any money back, we will pay it.