What is a Personal Tax Account?

How to set up your personal tax account - The reason why this is a good move for you.

It’s easy to register and set up your personal tax account with HMRC (HM Revenue and Customs); all you have to do is fill in your personal details and verify your identity with a passport or photocard driving license, a recent payslip, or p60 on the government’s site and choose a password. Your personal tax account allows you to check your details and manage various tax services with HMRC on their gov.uk website.

Why set up a Personal Tax Account?

HMRC introduced the personal tax account in December 2015 as a way to make it easier for people to check records and manage their tax details online. It provides an easy way for you to manage your personal tax information without having to ring HMRC and be stuck in long queues.

Information

Once it is activated you can then allow us access so that we can view your personal tax information. With all this at our fingertips, our expert accountants will have enough knowledge to make sure that you don’t miss out on anything that your owed and get you the maximum refund possible.

Speed

Having access to your personal tax account will also help us to get your refund into your bank account much quicker as we can find other important information that we need to progress your claim like your UTR number if you already have one. Also when it comes to us doing the next tax refund for you the following year we will have access from the start and the refund will go even quicker.

YOUR TIME is precious

Time is precious and you are working hard, earning money so that you can spend time on the things that matter like your family and friends. Having your personal tax account set up and allowing us access will free up loads of the time so we can do the work for you. No more trawling through boxes and files looking for old p60’s and payslips or waiting on the phone to an old employer asking for your PAYE reference number or tax information. We would rather you were having fun with your refund.

Click this button to set up your personal tax account on the gov.uk website

What will I need to set up my personal tax account?

Three simple steps

It won’t take too long to set up your personal tax account. If you are self-employed then it’s a lot quicker as you should have a Government Gateway ID. You obtain your number when you first register as self-employed and when filing your self-assessment tax return online.

- Click the button above to visit the government’s web page for setting up your personal tax account

- Choose the method you want them to use to verify your identity.

- Verify your identity using your National Insurance number, a recent payslip, P60, or your UK Passport

The process is very quick and will only take a few minutes and will speed up your refund process significantly once you grant us access.

How Far Back Can I Claim?

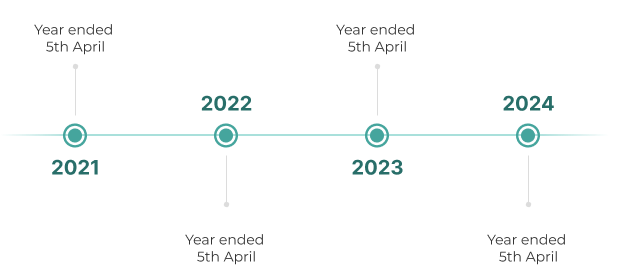

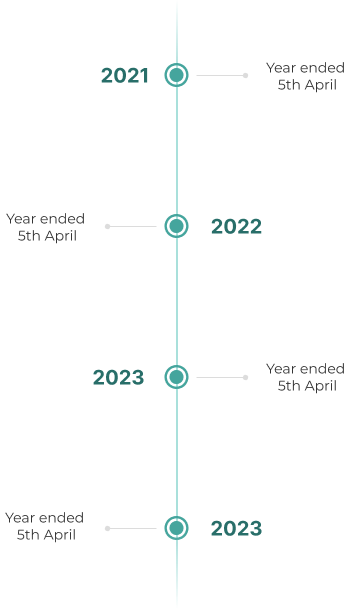

Current legislation in the UK says you can go back up to four Tax years when claiming a Tax rebate. This means at the current moment in time you can make a claim for the following periods:

- Year ended 5th April 2021

- Year ended 5th April 2022

- Year ended 5th April 2023

- Year ended 5th April 2024

Effectively this means you can claim Tax relief from 6th April 2020.

Over such a long period of time wage slips and p60s can be lost or misplaced. This isn’t a problem as you have lots of ways to obtain this information.

What Can I Claim Tax Back On?

You can claim tax back on most work-related expenses. Below is a list of items that you can request a tax rebate on:

- Vehicles for work use

- Fuel/Mileage costs

- Travel expenses

- Overnight expenses (food in certain circumstances)

- Rail Tickets (single & season tickets)

- Uniforms, work clothing and tools

- Cleaning costs for uniforms

- Professional fees, subscriptions & unions fees

This list is an example of what you could claim back; there may be expenses & items specific to the job role that you could claim back.

Customer Stories

Civil engineer Dean claimed back over £520

Hi, my name is Dean and I work as a civil engineer. Richard contacted me via Linkedin regarding a tax return that I might be owed he took me through step by step and was always at the end of the phone to get me my return. Now I’m £520 better off thanks to Rich, great work Swift Refunds!

Dean, Civil Engineer

Plant Operator Scott claimed back over £2,000

Hi there, my names Scott I’ve been using Swift for the last 2 years, I’ve just got over £2,000, all you need to do is fill out the easy forms and Swift do the rest it’s really that simple.

Scott, Plant Operator

Am I Due Any Tax Back?

Most workers, whether employed or self-employed may be due a tax rebate for work-related items, expenses or because they have paid too much tax. HMRC do not know everyone’s individual circumstances, and it is up to the taxpayer to contact HMRC to see if they are entitled to any tax relief.

Other reasons for a tax refund may include pension payments, redundancy payments, interest from a savings account, PPI, or UK income if you are living aboard.

All claims for tax refunds and rebates are reviewed on a case by case basis. Use our tax claim form and answer a few simple questions to see if you could be entitled to make a claim.