Wrong Tax Code

Am I on the wrong tax code?

If you think you may be on the wrong tax code, you will need to contact HM Revenue & Customs immediately as you may be paying too much or too little tax on your salary. If you are paying too much, you will be able to claim a tax rebate.

What should I do if my tax code is wrong?

You can contact HMRC by email or by telephone (0300 200 3300) if you believe you are on the wrong tax code. You will need to provide all the necessary information below so they can resolve the issue as quickly as possible. It is vital the information you give is accurate and up to date.

- Full name (first name, middles names & surname)

- Date of birth

- National insurance number

- Current UTR Number (unique taxpayer reference number)

- Employer work number

- Employee number

- Pension provider’s tax reference number

- State or private pension payments

- Salary

- Company benefits (including health care & allowances)

- Any other income (savings, rental properties, self-employed income)

- State benefits (child benefits & tax credits)

- An email address

- A contact telephone number

Why does it matter to be on the correct tax code?

Whether you are paying too much or not enough tax on your income, this could affect your state pension when you retired from employment. If you have paid too much, you will be able to claim it back, but if you have not paid enough, you will need to pay HRMC the shortfall.

Submit Your Claim

Do you work in lots of different locations to do your job and think you may be due a tax rebate? Well, find out whether you’re entitled to make a Tax claim by answering a few simple Tax-related questions below.

How Far Back Can I Claim?

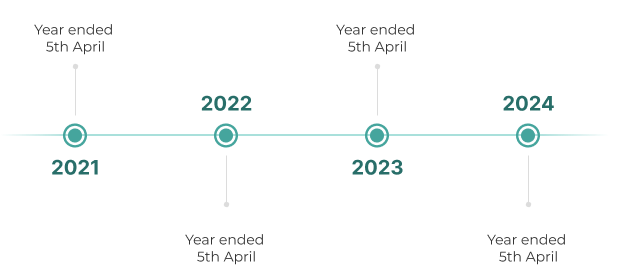

Current legislation in the UK says you can go back up to four Tax years when claiming a Tax rebate. This means at the current moment in time you can make a claim for the following periods:

- Year ended 5th April 2021

- Year ended 5th April 2022

- Year ended 5th April 2023

- Year ended 5th April 2024

Effectively this means you can claim Tax relief from 6th April 2020.

Over such a long period of time wage slips and p60s can be lost or misplaced. This isn’t a problem as you have lots of ways to obtain this information.

What Can I Claim Tax Back On?

You can claim tax back on most work-related expenses. Below is a list of items that you can request a tax rebate on:

- Vehicles for work use

- Fuel/Mileage costs

- Travel expenses

- Overnight expenses (food in certain circumstances)

- Rail Tickets (single & season tickets)

- Uniforms, work clothing and tools

- Cleaning costs for uniforms

- Professional fees, subscriptions & unions fees

This list is an example of what you could claim back; there may be expenses & items specific to the job role that you could claim back.

Customer Stories

Civil engineer Dean claimed back over £520

Hi, my name is Dean and I work as a civil engineer. Richard contacted me via Linkedin regarding a tax return that I might be owed he took me through step by step and was always at the end of the phone to get me my return. Now I’m £520 better off thanks to Rich, great work Swift Refunds!

Dean, Civil Engineer

Plant Operator Scott claimed back over £2,000

Hi there, my names Scott I’ve been using Swift for the last 2 years, I’ve just got over £2,000, all you need to do is fill out the easy forms and Swift do the rest it’s really that simple.

Scott, Plant Operator

Am I Due Any Tax Back?

Most workers, whether employed or self-employed may be due a tax rebate for work-related items, expenses or because they have paid too much tax. HMRC do not know everyone’s individual circumstances, and it is up to the taxpayer to contact HMRC to see if they are entitled to any tax relief.

Other reasons for a tax refund may include pension payments, redundancy payments, interest from a savings account, PPI, or UK income if you are living aboard.

All claims for tax refunds and rebates are reviewed on a case by case basis. Use our tax claim form and answer a few simple questions to see if you could be entitled to make a claim.